Yesterday, the general manager of Bologna, Claudio Fenucci, officially reiterated a thought which has long been his position.

Fenucci’s thought is that transmitting 100% of the matches on live pay TV is bad for the league because it undermines the stadium attendance.

The alternative is to follow the Premier League model that transmits live only 44% of the matches on the UK national territory (on Saturday there are no matches on TV at 3pm, thus encouraging people to go see football live at the stadium, according to their residence).

Fenucci’s second point was about the need to change the format of Serie A in order to return to a league with only 18 teams. This aspect is not independent of the issue of TV broadcast rights.

Fenucci’s statement opens up the debate in a particularly hot time on the front of the League, the Football Federation and the TV broadcast rights.

Why Fenucci?

Bologna’s general director shares these ideas and strategies with his president, Joey Saputo.

His thoughts attract the big clubs more than the smaller ones: two fewer spots in Serie A is a risk for the less well-equipped clubs and a liberation for the big clubs (the four midweek matches would disappear from the calendar – changing from 38 to 34 games).

With that being said, Fenucci has politically put his Bologna among the big clubs. It means that Bologna’s owner has broad economic guarantees about the continuity and solidity of the project.

Bologna was the right club to go ahead with this move. If the same words were said by the general manager of a top club the smaller teams would have immediately come together.

The Rossoblu’ (nick name for Bologna – Red-and-blues) have been in Serie A for only two years and are among the clubs in the later stage of the stadium discussion (even without any guarantees). They have foreign ownership which obviously is being closely watched by other clubs for the strategies that they put in action.

Significant fact: by not playing all the games on TV, Italy could come closer to the possibility of adopting the British model of TV distribution rights. A mechanism that is based on 50% equal for all, 25% from the field results and 25% according to the TV appearances (from a minimum of ten guaranteed to a maximum of 25).

This situation cannot leave the smaller teams uninterested. On the other side, the mid-rank clubs would see their income grow by bringing Serie A to a more acceptable ratio of those who take more and those who take less.

In short, giving up two spots in Serie A may have some interesting outcomes.

We cannot say if it will be enough, but the ball is rolling now, and the deal is on the table – perhaps already in negotiation at this moment.

OBJECTION: LESS GAMES MEAN LESS MONEY.

Not necessarily. Objection overruled.

Why?

There is a false belief of the average fan that thinks that the TV rights are weighted or based on the amount of games that are broadcasted.

False.

In reality TV pays based on the quality of the games. Not having two games a week for a total of 76 games a year means having lower costs for events that often have a very marginal audience.

In our analysis from last year we noted (looking at the first 20 league games) ten games with less than 15,000 TV spectators, which means that the teams that are not followed at the stadium are not even followed on TV.

A match like Juventus – Inter is worth 30 times the sum of 10 games with less audience.

Moreover, last year we highlighted how the “minor” games have had proportionally a much lower audience than their economic value per package.

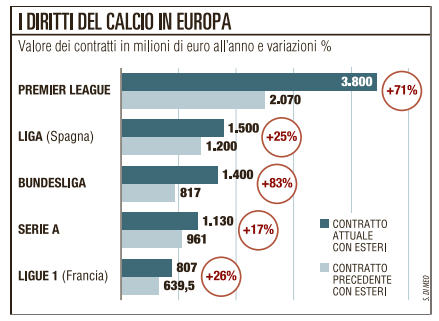

To prevent a depreciation of the rights you have to mostly balance the packages well. This factor has led to an increase of 70% on the previous three years in England.

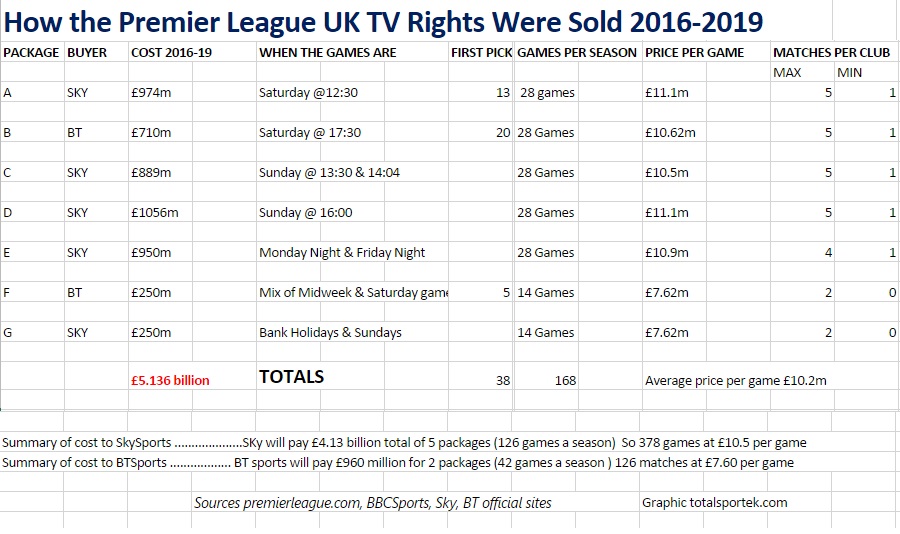

Let’s take a look at these packages:

THE TIMING.

The current agreement will apply for another two seasons, i.e. until 2017-2018.

In spring 2017 there will be a new auction.

The new agreement will be put in place in 2018-2019.

This means that if the Serie A League would vote for a reduction to 18 teams, the next season (2017-2018) should be the one with more relegation in order to start with the new format in 2018-19. Probable hypothesis: four relegation and only two promotions.

It would be an extraordinary season for TV as well as there would also be the return of four Italian teams in the Champions League.

THE PACKAGES.

Fenucci’s words advertise what is primarily a message that certainly is already clear to Infront and its new president Luigi De Siervo.

The advisor must submit new packages in the spring.

The reference to the English model in some way also gives a working track. No longer mega conglomerates as what happened in 2014 (with an auction that ended on the judges’s desk with the result of fines for Mediaset, Sky, Football League and Infront), but a different formula.

For example: no more “super package” that assigns all the matches and that creates an all-in-one effect but diversification for days and time slots, just like in England.

Then there is the issue of the game not being encrypted. It would be difficult for the Parliament to be able to impose it by law, but with the goal of diversification Infront (being insensitive to the wishes of politics) could propose an ad-hoc package for a game placed at 6pm on Sunday, with some stakes (like the exclusion of the top teams to give visibility to low/mid rank teams, just like in Spain).

THE PLATFORMS.

One of the difficulties of the moment is to identify who might be the potential bidders.

The recent events that Mediaset experienced have brought up even the possibility that Sky could have had a real competitor.

We must understand how the rights will be handled in relation to the different platforms. New companies, such as the German DAZN, could enter the national market. Infront has already shown great attention to all these issues.

Will streaming be considered different from satellite?

When Premium arrived on the market this was the case, with the effect that today’s big matches are not granted exclusively, because games such as Juventus-Inter are broadcasted on two different platforms.

But if the target to re-value the stadiums will be the one indicated by Fenucci, the weapon of “exclusivity” (one issuer for a single event) will be an added value in the research on how to maximize revenue from the sale of packages.

WHAT WILL TV SAY?

Given that recent rulings on the Infront case have clarified that incestuous relationships and conflicts of interest between those who sell and those who buy are not allowed, it is clear that someone will be unsatisfied, or at least with the market position downsized compared to now.

Sky TV for example could lose the right to broadcast all the Serie A games, however, it could participate in the allocation of exclusive un-encrypted packages. This would allow them to be able to boost their Tv8 that has been already rewarded in the ratings with the live broadcasting of the Europa League.

Even if Mediaset would be at risk of losing a lot of games it would be projected in a new balance of power with its competitor Sky (assuming it still would be at that time) with the opportunity to put its hands on the “un-encrypted” in a race that would involve also RAI and Discovery.

In short, if Infront will present 7-8 well-formed packages, revenues from the sales during the period 2018-2021 could bring interesting surprises.

The real risk for the fans would be another one, no one could at that point buy all the Serie A matches (because not all would be broadcasted).

The right to see the greatest number of matches from a single team with a single subscription would be reserved for the club through stadium subscriptions. Which would mean bringing the clubs and their stadiums to the center of the system.