UEFA has released its eighth annual club licensing benchmarking report on the financial health of its member associations for the 2015 financial year. The 130 page document provides a detailed analysis and comparison of UEFA’s 55 member associations on a multitude of topics. According to the report, Financial Fair Play has made a significant impact on European football as the measures have led to a more stable financial environment.

UEFA President Aleksander Ceferin claims that “UEFA’s regulatory role in financial fair play has not only steadied the ship of European football finances but also provided the framework for unprecedented growth, investment and profitability. It has turned around football finances – aggregate operating profits rose to €1.5bn in the last two years, compared with losses of €700m in the two years immediately prior to the introduction of the break-even requirement.“

Although the financial situation has improved in the past two years, there is a significant issue about the disparity and distribution of the wealth. Ceferin is concerned about “a return to high wage growth and the increasing concentration of sponsorship and commercial revenue among a handful of clubs.”

In fact, it is the elite clubs of Europe that significantly accounted for the growth, leaving very little for the rest. As the gap between the elite super clubs and the rest widens, concerns will arise about the competitiveness in national and continental competitions. Apart from a few exceptions (Leicester last year, Inter in 2010)– it is always the same elite clubs that are winning. It is a trend that will be difficult to reverse in the short term. Furthermore, this data will fuel the continued speculation of the creation of a European Super League.

The English Premier League’s financial dominance over its peers has continued to grow with significant increases in broadcaster, sponsorship and gate receipt revenue. However it is still the Spanish giants Real Madrid and Barcelona that occupy the top two spots.

Table: Top 20 clubs by revenue, fiscal year 2015

| Club | Country | Revenue |

| Real Madrid | ESP | €578m |

| Barcelona | ESP | €561m |

| Manchester United | ENG | €521m |

| Paris Saint-Germain | FRA | €484m |

| Bayern München | GER | €474m |

| Manchester City | ENG | €461m |

| Arsenal | ENG | €449m |

| Chelsea | ENG | €413m |

| Liverpool | ENG | €388m |

| Juventus | ITA | €325m |

| Borussia Dortmund | GER | €281m |

| Tottenham | ENG | €258m |

| Schalke | GER | €219m |

| Milan | ITA | €217m |

| Zenit | RUS | €196m |

| Wolfsburg | GER | €191m |

| Roma | ITA | €181m |

| Bayer Leverkusen | GER | €176m |

| Inter | ITA | €172m |

| Newcastle | ENG | €170m |

Key findings from the report:

• The top 15 European clubs have added €1.51bn in sponsorship and commercial revenues in the last six years (148% increase), compared to the €453m added by the rest of the 700 top-division clubs in Europe (17% increase).

• Aggregate operating profits have risen to €1.5bn in the last two years, compared to losses of €700m in the two years immediately prior to the introduction of Financial Fair Play.

• Aggregate losses have dropped by 81% since the full introduction of Financial Fair Play ─ from €1.7bn in 2011 to just over €300m in 2015.

• Net club debt as a percentage of revenue has fallen from 65% in 2009 to 40% in 2015.

• Football club revenues have increased for 20 consecutive years, now reaching almost €17bn for clubs in European top divisions.

• Number of clubs with a single-year loss of more than €45m fell from 11 clubs in FY11 to four clubs in FY15.

• European club football is enjoying unprecedented levels of investment – 58 new club stadiums were completed between 2014–2017, compared to 23 in the previous four-year period.

• European club revenues are now six times levels in 1996, averaging 9% growth per year

• Wages absorbed 63% of clubs revenues in 2015, up on last year but down from previous years

• The wage bill of England’s Premier League more than double next highest spending league, Italy’s Serie A

Serie A – two areas of concern

Growth Rate

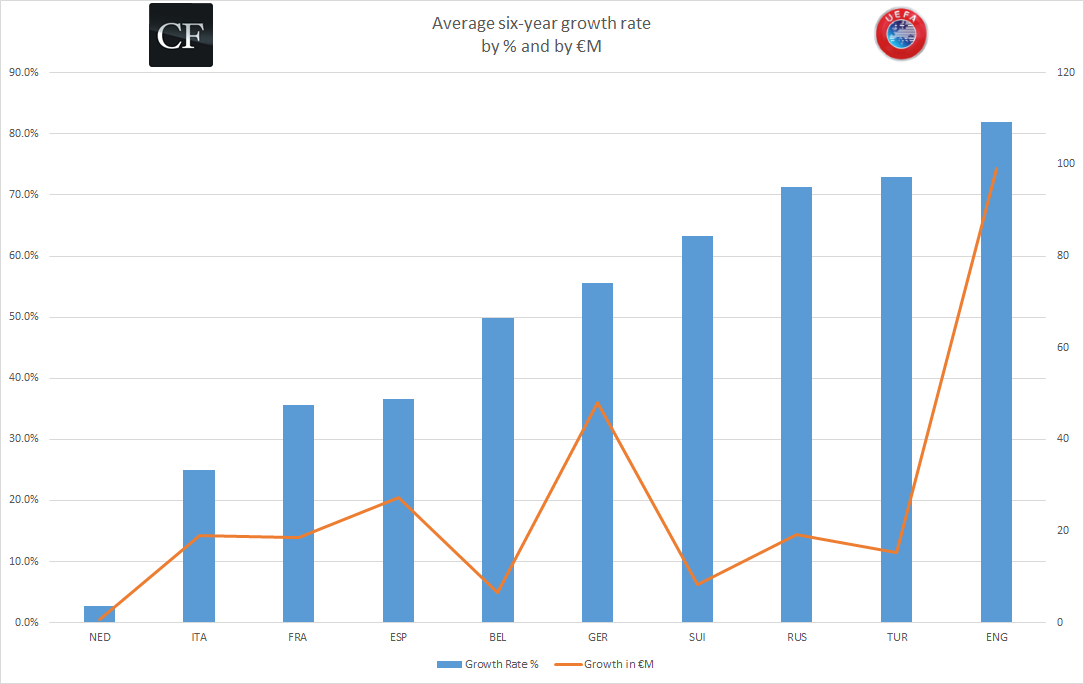

Between fiscal years 2009 and 2015, clubs in the top ten leagues have increased their revenues by an average of 49%, meanwhile in Italy the growth rate was at 24.9%, placing it 9th amongst the top 10 leagues. It is one thing for Serie A to be in the shadow of English Premier League, quite another to be surpassed by the likes of Russia, Turkey and Switzerland. Given the size of Italy’s population and the history and prestige of Serie A, this is a disappointing trend. At a minimum you would expect Italy to be in the top 5.

Revenue Mix

Another area of concern for Serie A is the revenue mix. Among the top 20 leagues, Italy ranks first for the amount of revenue coming from broadcasting, at 50%. When the bulk of your operating revenue is from TV rights, it demonstrates a weakness in other areas such as gate receipts, sponsorships and other revenues. Revenues should be diversified and not allocated to such a high degree in one category.

If we assume the profitable clubs in Italy have similar percentages, this acts as a disincentive for said clubs to want to change and remain with the status quo. In other words, if TV revenues cover the bulk of the costs, clubs won’t be too concerned about improving the fan experience at games to increase ticket sales.

The same logic can apply to sponsorships, particularly on the international scene. There are opportunities for clubs to market themselves on the international stage and reap the benefits of growing the fan base abroad. Italy should emulate the other leagues who have done this rather well, especially taking advantage of the Italians living abroad who still have a connection to their heritage and Italian ancestry.